Return on Investment for Financial Assistance for Living Kidney Donors in the United States.

1Mayo Clinic, Phoenix

2Arbor Research Collaborative for Health, Ann Arbor

3ASTS, Arlington

4Washington University in St. Louis, St. Louis

5University of Michigan, Ann Arbor.

Meeting: 2016 American Transplant Congress

Abstract number: 448

Keywords: Donation, Economics, Kidney transplantation, Public policy

Session Information

Session Name: Concurrent Session: Living Donation and Transplant: Operational and Economic Factors

Session Type: Concurrent Session

Date: Tuesday, June 14, 2016

Session Time: 2:30pm-4:00pm

Presentation Time: 2:42pm-2:54pm

Presentation Time: 2:42pm-2:54pm

Location: Room 311

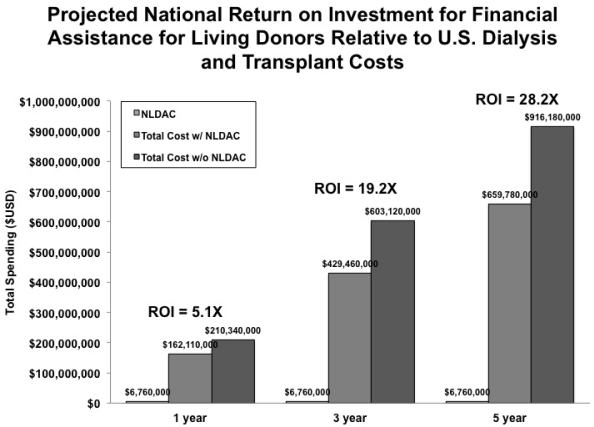

Background: Federal financial support through the National Living Donor Assistance Center (NLDAC) assists potential living donors who have prohibitive out-of-pocket expenses. We calculated the return on investment (ROI) of the NLDAC program versus continued dialysis care costs for US kidney transplant candidates.

Methods: We created a simulation model based on 2012-2015 data from NLDAC, the United States Renal Data System, and the Scientific Registry of Transplant Recipients. ROI was defined as average state-specific federal spending for dialysis minus (NLDAC program costs plus average state-specific transplant cost), expressed as a multiple of total NLDAC costs and calculated for 1-year, 3-year, and 5-year time horizons. The competing risk of deceased donor (DD) transplant on ROI was included using donor service area (DSA)-based median waiting time (WT). ROI was discounted to account for the donors who indicated that they could not have donated without NLDAC support (75.6%).

Results: 2425 NLDAC applications were approved over 4 years. NLDAC program costs were USD $6.76 million. Median donor age was 41 years, 63.5% were female, and median income was $32,389. Median dialysis cost/patient/year was $81,485 (2.3-fold state-state variation). Median kidney transplant cost/patient/year was $30,101 (3.4-fold state-state variation). 42% of applicants lived in a DSA with WT >72 months. ROI and total U.S. spending are shown below. ROI varied across states at 1 year (interquartile range (IQR) 3.9-6.6),3 years (IQR 14.0-23.0) and 5 years (IQR 15.3-34.0). Higher ROI was seen in areas with longer waiting times, larger differences in dialysis and transplant costs, and higher proportions of NLDAC applicants undergoing nephrectomy.

Conclusions: Financial support for living kidney donor out-of-pocket expenses produces dramatic savings in health care spending through incremental live-donor transplants in areas with long WT.

CITATION INFORMATION: Mathur A, Xing J, Dickinson D, Warren P, Gifford K, Hong B, Ojo A, Merion R. Return on Investment for Financial Assistance for Living Kidney Donors in the United States. Am J Transplant. 2016;16 (suppl 3).

To cite this abstract in AMA style:

Mathur A, Xing J, Dickinson D, Warren P, Gifford K, Hong B, Ojo A, Merion R. Return on Investment for Financial Assistance for Living Kidney Donors in the United States. [abstract]. Am J Transplant. 2016; 16 (suppl 3). https://atcmeetingabstracts.com/abstract/return-on-investment-for-financial-assistance-for-living-kidney-donors-in-the-united-states/. Accessed March 5, 2026.« Back to 2016 American Transplant Congress